Shareholder-Friendly Management

Protection of Shareholder Rights

SK Gas is committed to protecting the rights of its shareholders and investors. We have improved internal practices for general meetings and information disclosure to provide accurate information promptly. Additionally, we have diversified our information disclosure methods and established an internal information delivery system to enhance information accessibility.

We ensure that general shareholders can exercise their rights at general meetings. Each shareholder is guaranteed one vote per share, and decisions on matters significantly affecting the company and shareholder rights, such as mergers or business transfers, are made in ways that maximize shareholder rights at general meetings. These rights and their protections are outlined in our corporate governance charter.

Voting Methods at General Meetings

To facilitate the exercise of voting rights and secure a quorum, we have introduced electronic voting. We also implement a proxy solicitation system for all shareholders, making it easier for them to exercise their voting rights. Additionally, shareholders can indirectly exercise their voting rights by submitting written proxies.

| Item | Implementation Status |

|---|---|

| Written Voting | Not Implemented |

| Electronic Voting | Implemented |

| Cumulative Voting | Not Implemented |

| Guaranteeing Voting Rights via Written Proxies | Implemented |

| Electronic Proxy System | Implemented |

| Proxy Solicitation System | Implemented |

Separate Submission of Important Proposals

When presenting significant proposals, such as the appointment of executives or amendments to the articles of incorporation, each proposal is presented separately for each executive or clause to ensure that shareholders' intentions are accurately reflected. We also provide shareholders with key information on general meeting agendas in advance to allow sufficient time for informed decision-making. Information on executive candidates, including their relationship with major shareholders, affiliates, detailed career, reasons for board recommendation, delinquency status, legal employment restrictions, and other disqualifications, is provided to aid rational judgment. Directors appointed as audit committee members are elected separately from other directors, and a financial expert is included among the appointed audit committee members.

Shareholder Proposal Rights

To protect shareholder rights, we implement a shareholder proposal system. Shareholders holding a certain percentage of shares can propose matters for the general meeting up to six weeks before the meeting. Shareholders can exercise their proposal rights in writing or electronically based on the Commercial Act. If a proposal is made, the company reviews it according to internal procedures and presents it at the general meeting. Additionally, we strive to discuss various topics and forms of agendas in line with the growing interest in environmental and social responsibility management among shareholders.

Shareholders Meeting

Holding General Meetings

SK Gas holds regular general meetings, notifying and disclosing details such as the meeting location and agenda in accordance with Article 542-4 of the Commercial Act. The 40th general meeting in 2025 was notified three weeks in advance. To facilitate the attendance of general shareholders, we stagger the meeting dates of the company and major subsidiaries.

Decisions confirmed through general meeting resolutions are immediately disclosed to shareholders and other stakeholders. Key management matters closely related to investor interests are disclosed on the electronic disclosure system (DART), the Korea Exchange, and the SK Gas website.

| Year | Notification/Announcement Time | General Meeting Date |

|---|---|---|

| 2021 | March 15 | March 30 |

| 2022 | March 2 | March 24 |

| 2023 | February 28 | March 23 |

| 2024 | February 27 | March 21 |

| 2025 | February 24 | March 20 |

Results of the 40th Regular General Meeting

At the 40th regular general meeting held on March 20, 2025, all seven agenda items were approved as originally proposed. The detailed voting results for each agenda item are as follows.

| Agenda | Type of Resolution | Meeting Purpose | Approval Status | Total Issued Voting Shares (①) | Voting Shares (Out of ①) | Votes For (Percentage, %) |

|---|---|---|---|---|---|---|

| Votes Against/Abstentions (Percentage, %) | ||||||

| Agenda 1 | Ordinary | Approval of the 40th Fiscal Year Financial Statements (Including the Statement of Retained Earnings) and Consolidated Financial Statements | Approved | 8,975,046 | 8,008,925 | 7,965,097 (99.5%) |

| 43,828 (0.5%) | ||||||

| Agenda 2 | Ordinary | Appointment of an Inside Director (1 person, Yoon Byung-suk) | Approved | 8,975,046 | 8,008,925 | 7,972,365 (99.5%) |

| 36,550 (0.5%) | ||||||

| Agenda 3 | Ordinary | Appointment of an Other Non-Executive Director (1 person, Son Hyun-Ho) | Approved | 8,975,046 | 8,008,925 | 7,946,815 (99.2%) |

| 62,110 (0.8%) | ||||||

| Agenda 4 | Ordinary | Appointment of an Outside Director (1 person, Jeong Young-Chae) | Approved | 8,975,046 | 8,008,925 | 7,521,508 (93.9%) |

| 487,417 (6.1%) | ||||||

| Agenda 51) | Ordinary | Appointment of an Outside Director as an Audit Committee Member (1 person, Jeong Young-Chae) | Approved | 2,552,256 | 1,586,135 | 1,124,012 (70.9%) |

| 462,123 (29.1%) | ||||||

| Agenda 6 | Ordinary | Approval of Director Remuneration Limits | Approved | 8,975,046 | 8,008,925 | 7,998,580 (99.9%) |

| 10,345 (0.1%) |

| Shares Present2) | Voting Rights Excluding Major Shareholders and Special Relations3) | |

|---|---|---|

| 1,344,524 shares | Agenda Items 1-4, 6 | 14.98% |

| Agenda Item 5 | 51.60% | |

- 1) For Agenda Item No. 5: Proposal for the Appointment of Audit Committee Members, the 3% rule is applied when calculating the number of voting shares.

- 2) Number of Shares Present: Based on the total number of voting common shares present. Out of 8,008,925 shares, excluding the 6,664,401 shares held by the largest shareholder, SK Discovery.

- 3) Largest Shareholder and Related Parties: SK Discovery, Yoon Byung-Suk, Ahn Jae-Hyun.

Dividend and Stock Ownership Status

Dividend Policy

SK Gas has established a dividend policy to enhance shareholder value, which is disclosed to shareholders and announced through the website and IR materials to increase the stability and predictability of dividends. Our dividend policy for the next three fiscal years (2024-2026) is as follows:

-

(Base) Adherence to at least 25% of Annual Net Income attributable to owner of the Parent (Ordinary)

- Changed the dividend basis from ‘separate net income’

- Consider changes in the profit structure according to long-term growth directions

-

(+Alpha) Actively consider additional shareholder returns if the medium to long-term ROE target exceeds 12%

- Additional returns will be considered through cash dividends or share buybacks

(distributed over 1-3 years) if the target is exceeded, including non-recurring

income* from LNG-LPG Optionality execution.

*Non-recurring imcome from asset securitization are excluded - Utilize as resources for sustainable corporate value expansion

- Additional returns will be considered through cash dividends or share buybacks

(distributed over 1-3 years) if the target is exceeded, including non-recurring

income* from LNG-LPG Optionality execution.

-

Continuously implement interim dividends

Dividend Status

| Category | Type | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|

| Dividend per Share (KRW) | Common Stock | 3,000 | 4,000 | 5,100 | 6,500 | 8,000 | 8,000 |

| Preferred Stock | - | - | - | - | - | - | |

| Dividend Yield (%) | Common Stock | 3.4% | 3.8% | 3.8% | 5.2% | 5.3% | 3.7% |

| Preferred Stock | - | - | - | - | - | - | |

| Dividend Payout Ratio | Common Stock | - | - | Net Profit (Standalone) 20~40% |

Net Profit (Standalone) 20~40% |

Net Profit (Standalone) 20~40% |

Net Profit Attributable to Controlling Interests (Consolidated,

Recurring) 25% or more |

| Achievement Rate against Target(%) | Common Stock | - | - | 100.7% | 108.5% | 104.0% | 160.6% |

SK Gas provides various information to stakeholders through its website, including financial information, disclosures on the electronic disclosure system, notices regarding general meetings and auditor appointments, and quarterly IR materials. This ensures equal access to corporate information for all shareholders, beyond regularly disclosed items that may affect corporate value.

We have established and operate disclosure information management regulations to ensure that all disclosure information is accurate, complete, fair, and timely according to relevant laws. These regulations include disclosure control activities, risk assessment and management, monitoring, and prohibitions on insider trading by employees. Additionally, we designate disclosure managers and ensure that personnel receive training to enhance expertise and efficiency in disclosure tasks. We also expand access to corporate information through an ESG website to transparently disclose ESG management activities to various stakeholders.

Differences with Best Practices

| Category | Best Practice Recommendations | Implementation Status | Remarks |

|---|---|---|---|

| General | Adoption of a Corporate Governance Charter | Yes | Established on 2020-03-27 / Disclosed on ESG Website |

| Adoption of Employee Ethics Regulations | Yes | Established on 2009-01-01 / Disclosed on ESG Website | |

| Board of Directors | Separation of CEO and Board Chairman | Yes | Appointed an Outside Director as Board Chairman |

| Disclosure of Board Composition and Ratio of Outside Directors | Yes | As of 2021-12-31, the ratio of outside directors was 57% (3internal directors, 4 outside directors) | |

| Establishment of Committees under the Board | Yes | Operating Audit Committee, ESG Committee, Personnel Committee, and Outside Director Nomination Committee | |

| Adoption of Regulations on Roles and Procedures of the Board and Various Committees | Yes | Separate Regulations for the Board and Each Committee / Disclosed on ESG Website | |

| Regular Board Meetings | Yes | Disclosed in Business Report and ESG Website | |

| Provision of Information to Directors Before Board Meetings | Yes | Notice of Agenda Items 7 Days Before Board Meetings | |

| Disclosure of Board Activities, Attendance Rates, and Voting Results on Key Agenda Items | Yes | Disclosed in Business Report and ESG Website | |

| Board Committee Composition | Yes | Disclosed in Business Report and ESG Website | |

| Establishment of a CEO Succession System and Internal Regulations | No | Lack of a Formalized CEO Succession Policy | |

| Preparation of Board and Committee Meeting Minutes | Yes | Preparation and Preservation of Board and Committee Meeting Minutes | |

| Ensuring the Independence of Outside Directors | Yes | Independence Ensured through Regulations and Guidelines / Disclosed on ESG Website | |

| Ensuring the Expertise and Diversity of the Board | Yes | Independence Ensured through Regulations and Guidelines / Disclosed on ESG Website | |

| Evaluation of the Board and Board Committees | Yes | Disclosed in Business Report and ESG Website / SR Disclosure - Evaluation of Board Operations by Outside Directors | |

| Purchase of Directors' Liability Insurance at the Company's Expense | Yes | Directors' Liability Insurance Purchased | |

| Audit Organization | Composition of the Audit Committee (All Outside Directors) | Yes | Disclosed in Business Report and ESG Website |

| Enhancement of Audit Committee Expertise | Yes | Disclosed in Business Report and ESG Website | |

| Inclusion of Accounting or Finance Experts in the Internal Audit Function | Yes | Accounting/Finance Experts Included in the Audit Committee | |

| Holding Audit Committee Meetings at Least Quarterly | Yes | Disclosed in Business Report and ESG Website | |

| Provision of Annual Training for the Internal Audit Function | Yes | Conducted Internal Accounting Training Twice a Year | |

| Support for the Use of External Advisors | Yes | Formalized / Disclosed on ESG Website | |

| Maintaining the Independence of External Auditors | Yes | Disclosed on ESG Website | |

| General Meeting | Adoption of Cumulative Voting | No | Excluded |

| Notice of General Meeting Four Weeks in Advance | No | Notice Provided Three Weeks in Advance - '22.2.28: Notice of Meeting Resolution - '22.3.2: Notice of Meeting - '22.3.24: General Meeting Held | |

| Holding General Meetings on Non-Concentrated Dates | Yes | Implementing Staggered Meetings / Refer to ESG Website | |

| Disclosure | Certification of Accuracy of Business Reports, etc. | Yes | Certified by CEO and Responsible Executive |

| Korean and English Disclosure of Audit Reports and Important Ad Hoc Disclosures | No | Korean Business Reports and Audit Reports are disclosed, but there is no separate English version. Relevant information is provided in English through the ESG website. | |

| Explanation of Differences with Best Practices | Yes | Disclosed on ESG Website |

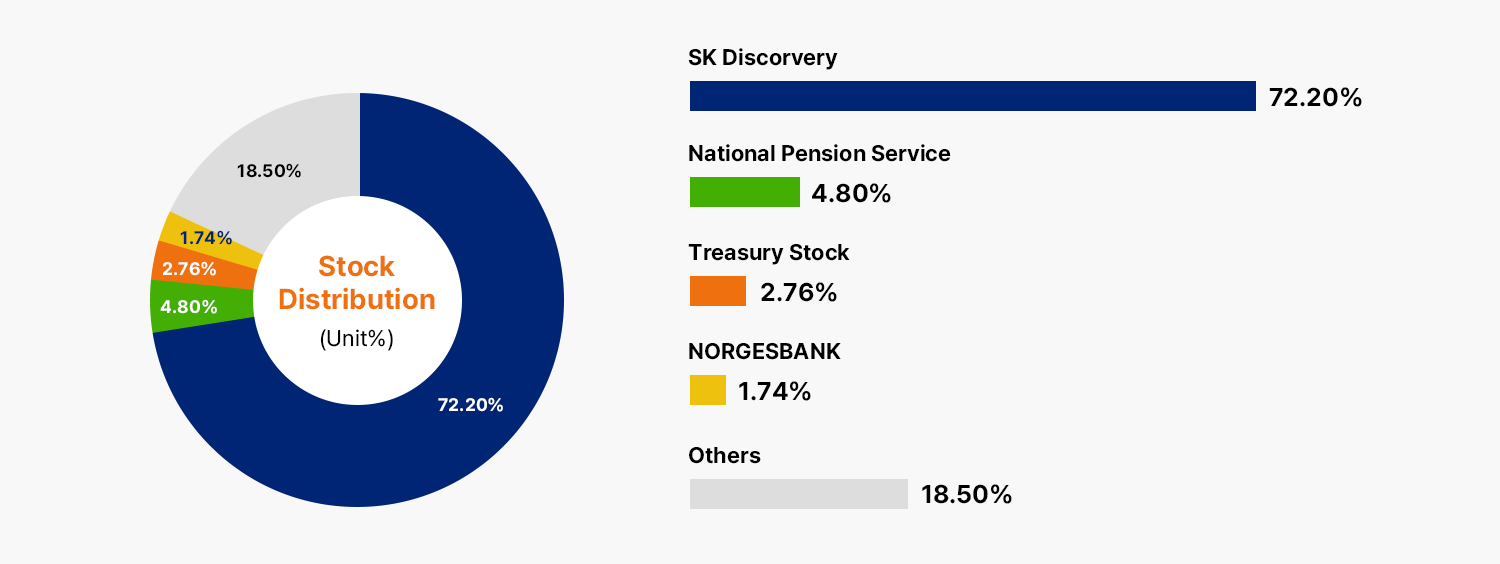

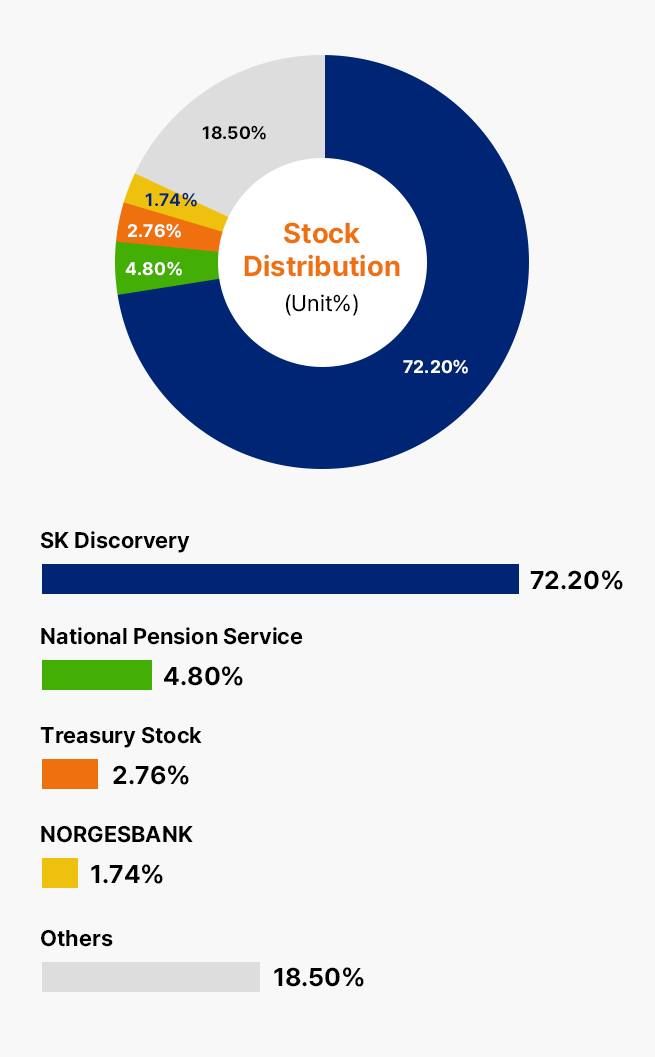

Ownership Structure and Legal Form

SK Gas is a joint-stock company under the Commercial Act. The current ownership status of the largest and major shareholders is as follows, and the same information is provided in the company's business report.

Stock Ownership Status

| Type of Stock | Total Issued Shares (Unit: shares) | Total Face Value (Unit: KRW million) | Remarks |

|---|---|---|---|

| Common Stock | 9,230,244 | 46,151 | - |

| Preferred Stock | 0 | 0 | - |

| Total | 9,230,244 | 46,151 | - |

- Face value of 1 share: KRW 5,000

- Based on the 40th term (end of 2024)

Status of Treasury Shares

| Type of Stock | Total Issued Shares (unit: shares) | Remarks |

|---|---|---|

| Common Stock | 255,198 | - |

| Preferred Stock | 0 | - |

| Total | 255,198 | - |

- Based on December 31, 2024

Stock Distribution Status

| Shareholder | Relationship | Common Shares | Preferred Shares | Total | |||

|---|---|---|---|---|---|---|---|

| Number of Shares | Ratio | Number of Shares | Ratio | Number of Shares | Ratio | ||

| SK Discovery | Largest Shareholder | 6,664,401 | 72.20 | 0 | - | 6,664,401 | 72.20 |

| National Pension Service | - | 296,891 | 3.22 | 0 | - | 296,891 | 3.22 |

| Treasury Shares | - | 255,198 | 2.76 | 0 | - | 255,198 | 2.76 |

| NORGES BANK | - | 256,526 | 2.78 | 0 | - | 256,526 | 2.78 |

| VIP Asset Management Co., Ltd. | - | 182,698 | 1.98 | 0 | - | 182,698 | 1.98 |

| Baring Asset Management Ltd. | - | 158,262 | 1.71 | 0 | - | 158,262 | 1.71 |

| Kyungdong City Gas | - | 94,647 | 1.03 | 0 | - | 94,647 | 1.03 |

| Others | - | 1,321,621 | 14.32 | 0 | - | 1,321,621 | 14.32 |

- As of: 2024-12-31, based on the shareholder register (closure)